|

Technical Approach

The Tactical Trading System has managed all of the Tactical Commodity Trading Program's

futures funds and accounts since its 1981 inception. It is the result of

over 29 years of ongoing research, evolving very slowly over time.

It uses a quantitative, technical approach described in detail in

our Disclosure Document. Its continuous performance since 1981 is reflected in the Tactical

Commodity Trading Program table and graph.

Projected Source of

Profits

Hedgers trade futures to transfer business risk and receive insurance

against adverse price moves. Tactical believes that hedgers must

therefore be net losers in futures over the long run, effectively

paying an insurance premium for the risk reduction they receive,

the "risk premium."

The Tactical Trading System

is based on capturing this risk premium. By attempting to fade hedgers

at technically determined price levels the System buys strength

and sells weakness, the opposite of hedging behavior, actually losing

money on the majority of trades. The winning trades, less frequent

but larger on average, occur when prices strengthen or weaken well

beyond expectations, forming trends.

Trend-following

a Natural Result

By fading hedgers, the System becomes

a trend-follower by default, but not by design. This is in contrast

to trading systems that are specifically designed to capture trends.

Our Trading System targets extra long-term price movements, not

uncommonly holding positions (with rolls) for over a year. This

frequently requires riding out significant counter-trends, contributing

to volatility in returns.

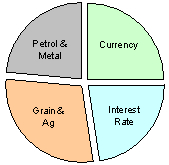

Portfolio Composition

The Tactical Trading System trades an

extremely well balanced and diversified portfolio of commodities

and currencies with low correlation to stocks and bonds. Markets

are selected to be as distinctly different from each other as possible.

Physical commodities such as grain, food, metal and petroleum futures

make up a little over half of the portfolio. Financial commodities

such as currency and interest rate futures make up the rest.

Money Management

The System uses proprietary money management

and risk control strategies designed to cut losses short and let

profits ride. Individual market risk and overall portfolio risk

are constantly reassessed. The initial risk on any given trade is

kept small, averaging about 0.5% of account equity. Statistical

boundary limits are established as stop-loss protection for the

overall trading program.

Aggressive Posture

The System adopts an aggressive investment

posture. It is volatile near-term in attempts to make above average

long-term gains. There is no guarantee that the System will make

money despite its successful historical performance. An investor

could lose a great deal of money. A Tactical investment is not for

everyone.

Robust Strategies

Our Trading System uses only robust trading

strategies. These are techniques based on general, successful trading

principles. They are not optimized and rarely exactly fit any specific

market situation. The system parameters are elegantly small in number

and identical across all markets. Robust strategies enhance potential

long-term success but at the cost of near-term volatility of returns.

From Tactical's standpoint, that is a great trade.

Investing with Tactical is

designed for sophisticated investors who are able to bear a substantial

or entire loss of their investment. Before seeking this advisor's

services read and examine thoroughly the Disclosure Document.

|